Part 4 of "The Myth of Middle Class Security" Series

May 11, 2025

Redefining Security: Building Stability in a Changed System

The structure of the U.S. middle class has shifted over time. What once worked as a broadly accessible financial model — based on single-income households, employer-sponsored benefits, and relatively affordable housing and education — no longer applies to many Americans today.

A New Economic Reality

Over the past several decades, core costs have increased faster than wages. According to the U.S. Bureau of Labor Statistics (2024), wage growth has not kept pace with inflation. Meanwhile, the costs of housing, healthcare, childcare, and higher education have risen sharply.

In response to this shift, many households now use multiple income streams to maintain or build financial stability. This approach reflects a structural change — not personal mismanagement.

Types of Income to Consider

Building layered income sources can increase resilience and financial flexibility. These categories represent common income pathways in today’s system:

-

W-2 Income: Traditional employment or business income.

-

Freelance / Contract Work: Monetizing skills outside of primary employment (e.g., writing, consulting, tutoring, trades).

-

Digital Income: Courses, affiliate programs, ebooks, or licensing digital products.

-

Asset-Based Income: Income from real estate, dividends, royalties, or owned intellectual property.

This model does not require implementing all income source types. Adding one manageable income source can strengthen overall financial security over time.

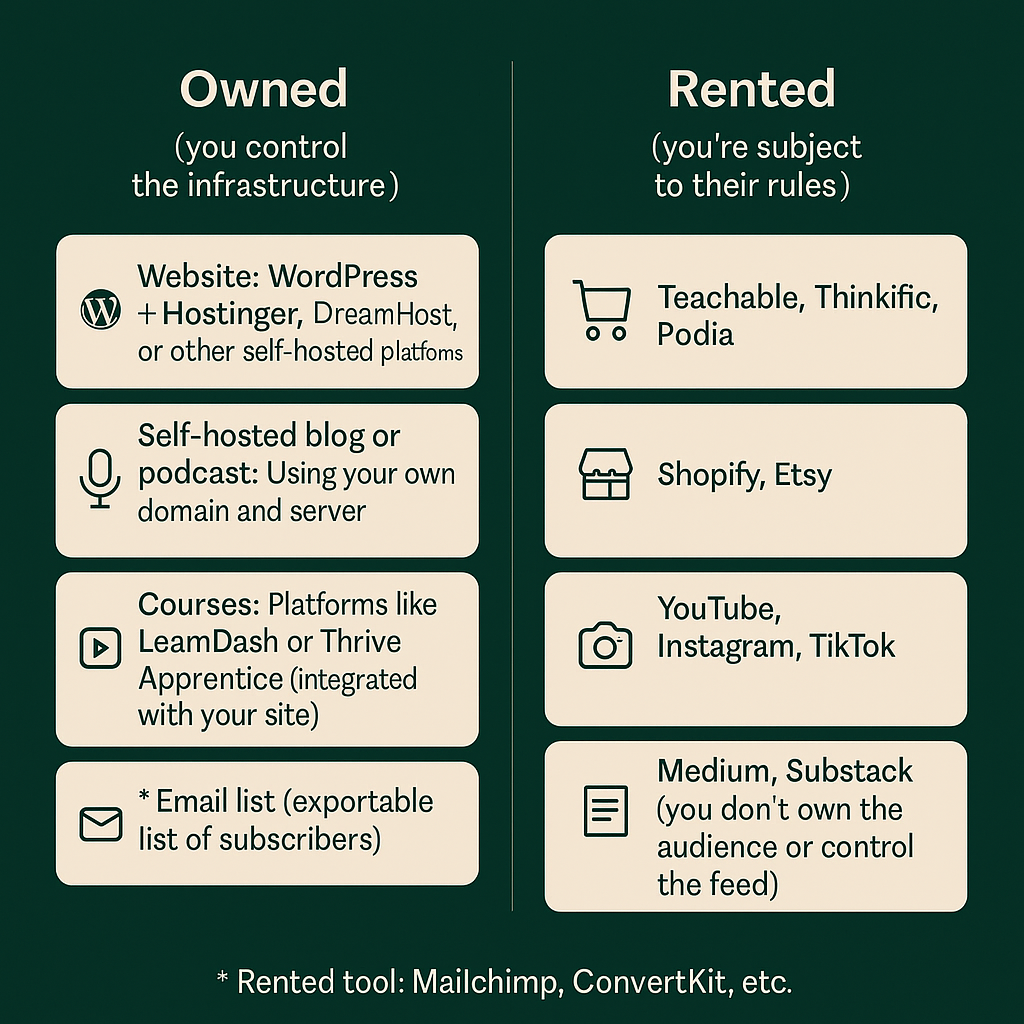

Platform Ownership and Digital Control

In today’s digital economy, controlling the platform through which your skills, products, or services are delivered is a critical component of long-term security.

Owned Platforms: A self-hosted website, blog, podcast, or course site (e.g., WordPress + LearnDash) offers more control and flexibility.

- Rented Platforms: Social media and third-party tools (e.g., Instagram, TikTok, YouTube, Shopify, Teachable) are widely used but subject to changing terms, algorithms, or platform decisions.

While using rented platforms is often practical, it’s important to understand what you control — and what you don’t. For example:

-

Email Lists: While the delivery platform (e.g., ConvertKit, Mailchimp) is rented, regularly exporting your list means you retain ownership of the data.

Knowing how to pivot between platforms and maintain access to your audience independently increases long-term sustainability.

Owned Platforms: Your own website (e.g., WordPress + Hostinger), blog, podcast, or self-hosted course using tools like LearnDash.

- Rented Platforms: YouTube, Instagram, TikTok, Substack, Shopify, Teachable — platforms that can change terms or limit reach at any time.

🔹 Email lists are in a gray zone. You don’t control the delivery platform (like Mailchimp or ConvertKit), but you do own the list if you export it regularly. That makes it one of the most valuable digital assets you can build.

Owning the platform gives you reach and resilience. It ensures you’re not at the mercy of someone else’s algorithm — or business model.

That doesn’t mean you have to avoid rented platforms. They can offer convenience, visibility, and ease of use. I currently use Kajabi for its simplicity — but because I don’t own the platform or control access, I’ve taken steps to ensure I can still reach my audience if that access ever changes.

The key is to use these tools with awareness: know what you're relying on, what you control, and what your backup plan is.

Flexibility as a Financial Tool

Modern financial security often depends on adaptability rather than a fixed formula. This may include:

-

Starting a small side service based on existing skills

-

Renting out personal assets (e.g., a room or vehicle)

-

Freelancing in your current field

-

Monetizing a hobby or area of expertise

These actions do not require significant capital or long-term commitment, but they can create financial resilience. Resilience today isn’t about how hard you hustle — it’s about how many directions you can move when things shift. Flexibility is the new safety net.

Expanding the Definition of Ownership

Traditional definitions of ownership focused on tangible assets like a home or vehicle. Today, ownership includes:

-

Digital Assets: Domains, websites, online courses

-

Intellectual Property: Trademarks, books, licensed content

-

Time Control: Building work structures aligned with personal needs

-

Durable Skills: High-demand, transferrable skills in both digital and physical trades

Ownership of these assets increases leverage, reduces dependency, and strengthens personal financial ecosystems.

Rebuilding Security on Your Terms

This series unpacked how the middle class was built, reshaped, and in many cases, left behind. It’s clear the system changed — from wages and housing to debt and generational opportunity — but that change doesn’t remove your power. It just requires a different kind of awareness.

In a world full of financial noise, it’s easy to get pulled into quick-fix promises — viral side hustles, overnight success stories, or content designed to profit from your panic. But those aren’t strategies. They’re distractions.

Real financial security today isn’t about chasing the next hack. It’s about understanding the game, choosing your next step with intention, and building a structure that fits your life — not someone else’s algorithm.

You don’t need to go faster. You need to go forward with clarity.

The old blueprint no longer applies. But the ability to build security remains — through strategy, ownership, and informed action. Start with what you own, what you know, and what you can manage — and keep moving from there.

Security may seem out of reach for the middle class — but it isn’t. It takes new tools, clear thinking, and a plan built for the system we’re in now.

If this blog gave you insight, the community will give you depth and strategy.