HR1 2025: Complete Guide to Trump's One Big Beautiful Bill Act - What Changes for Your Taxes, Benefits & More

Jul 04, 2025

HR1 "One Big Beautiful Bill"

What's Actually In It?

How the Bill Passed

The One Big Beautiful Bill Act passed through Congress using budget reconciliation. Budget reconciliation lets Congress pass spending bills with just 51 Senate votes instead of 60. This avoids filibusters. Republicans used this process with their narrow majority.

Key Vote Margins:

- House: 218-214 (July 3, 2025)

- Senate: 51-50 with VP Vance tiebreaker (July 1, 2025)

Notable Opposition: Only 2 House Republicans voted against the bill. Rep. Thomas Massie (KY) and Rep. Brian Fitzpatrick (PA) joined all Democrats in voting no.

Freedom Caucus members first opposed the bill. They wanted more spending cuts. But they switched their votes after White House negotiations with President Trump.

Major Changes During Passage: The Senate voted 99-1 to remove the AI moratorium provision. Sen. Marsha Blackburn (R-TN) led the opposition. Rep. Marjorie Taylor Greene also threatened to vote against the bill if the AI moratorium remained.

The Senate modified several provisions. This included Medicaid cuts and tax deduction caps. The House accepted Senate changes to meet Trump's July 4 deadline. Trump is scheduled to sign bill July 4, 2025.

What This Bill Actually Is

The One Big Beautiful Bill Act is a "reconciliation" bill. Republicans used this process to pass it with their narrow majority.

The bill does two main things:

- Extends tax cuts from 2017 that were set to expire

- Adds new spending and tax changes

The Congressional Budget Office says the bill will add $3.4 trillion to the national debt over 10 years.

Your Income Taxes

What Changes:

- Tax rates from 2017 are now permanent (they were set to expire in 2025)

- Standard deduction stays higher than before 2017

- Child tax credit stays at $2,000 per child

- State and local tax deduction increases from $10,000 to $40,000 (but only if you make under $500,000)

The standard deduction is the amount you subtract from your income before calculating taxes.

What This Means: Most people will pay the same income tax they've been paying since 2017. Without this bill, your taxes would have gone up in 2026.

For Someone Making $100,000: Your taxes will likely stay the same or decrease slightly. You'll benefit from keeping the current tax brackets and higher standard deduction. The exact amount depends on your filing status and deductions.

The state and local tax change mainly helps people in high-tax states like New York and California.

Tips and Overtime

What Changes:

- Workers making under $150,000 can deduct tips and overtime pay from their taxes

- The deduction is capped at $25,000 total

- This expires in 2028

What This Means: Servers, bartenders, and overtime workers will pay less income tax. But there's a catch. You still pay Social Security and Medicare taxes on that money.

Example: If you made $5,000 in tips, you might save $1,000-1,500 in income taxes. But you still pay the 7.65% payroll tax on the full $5,000.

Car Loans

What Changes:

- You can deduct up to $10,000 per year in auto loan interest

- Only for cars made in the United States

- Only for cars bought between 2025-2028

- Phases out if you make over $100,000 (single) or $200,000 (married)

What This Means: This works like the mortgage interest deduction, but for car loans. If you're buying an American-made car and financing it, you might save $2,000-3,000 in taxes per year.

Senior Citizens

What Changes:

- New tax deduction of up to $6,000 for people over 65

- Phases out if you make over $75,000 (single) or $150,000 (married)

- Expires in 2028

What This Means: Many seniors will get a tax break worth $1,200-2,000 per year. But higher-income seniors won't qualify.

Business Taxes

What Changes:

- Companies can immediately write off 100% of equipment costs

- Research and development costs can be written off immediately again

- Small business tax deduction increases from 20% to 23% and is made permanent

Companies used to spread equipment costs over several years. Now they can deduct the full amount right away.

What This Means: Companies will pay less in taxes, especially if they buy equipment or do research. The idea is this will encourage business investment and job creation.

For Small Businesses: This is a big win. The small business deduction (called Section 199A) lets you deduct 23% of your business income. That's up from 20%.

If you made $100,000 in business income, you could deduct $23,000. This might save you $5,000-8,000 in taxes. The deduction is now permanent instead of expiring in 2025.

You can also immediately write off equipment purchases up to $2.5 million. That's doubled from $1.25 million.

Border Security and Immigration

What Changes:

- $60 billion over 4 years for border security

- $46.5 billion specifically for building physical barriers (walls/fences)

- New fees for people seeking asylum

- Tax on money sent to other countries

What This Means: This is the largest border security spending in U.S. history. The money goes to:

- Building and improving border walls

- Hiring more border patrol agents

- Detention facilities

- Technology like cameras and sensors

The tax on money sent abroad means if you send $500 to family in another country, you'll pay an extra fee.

What This Doesn't Change: This bill does NOT change immigration policy itself. It doesn't:

- Change how many people can legally immigrate

- Modify visa categories or green card processes

- Address DACA or other immigration programs

- Change asylum laws or deportation procedures

This is purely about enforcement and border infrastructure, not immigration reform.

Child Tax Credit Changes

What Changes: Parents must have a Social Security Number to claim the Child Tax Credit. This affects about 4.5 million children who are U.S. citizens but have parents without SSNs.

What This Means: Some American citizen children will lose the $2,000 Child Tax Credit. Their parents don't have Social Security Numbers. This mainly affects mixed-status families.

Food Assistance (SNAP)

What Changes:

- Only U.S. citizens and permanent residents can get food stamps

- Work requirements extended to age 64 (up from 54)

- Parents with children over age 7 must now work (currently over age 18)

- Cuts federal matching funds for states with high error rates

- States must pay 5-25% of benefit costs starting in 2028

What This Means: Fewer people will qualify for food assistance. The income limits for SNAP didn't change. But the work requirements got much stricter. About 5.4 million people could lose some or all benefits.

Income Limits Stay the Same: To qualify for SNAP, you must still be at or below 130% of the federal poverty line. That's about $2,800/month for a family of three. The income limits didn't change - the work requirements did.

Green Energy Credits

What Changes:

- Cuts about $500 billion from green energy tax credits

- Eliminates electric vehicle tax credits

- Eliminates residential solar tax credits

- Keeps some credits for carbon capture and clean fuel production

What This Means: It will be more expensive to buy electric cars and solar panels. The government will spend less money encouraging clean energy.

The AI Moratorium (Removed)

What Was Proposed:

- A 10-year ban on states regulating artificial intelligence

- States couldn't enforce laws about AI systems or automated decisions

- Would have overridden existing state AI laws in places like California, New York, and Colorado

- States that violated the ban would lose federal broadband funding

What Happened: The Senate voted 99-1 to remove this provision from the bill. Even Republican senators who supported the overall bill voted to kill the AI moratorium.

Why It Was Removed: Senator Marsha Blackburn (R-Tennessee) led the opposition. She was concerned it would block Tennessee's "ELVIS Act" protecting musicians from AI voice cloning.

Rep. Marjorie Taylor Greene (R-Georgia) initially voted for the House version. But she threatened to vote against the final bill if the Senate did not remove the AI moratorium provision.

Child safety advocates worried it would prevent states from protecting kids online. 40 state attorneys general opposed it. 250 state lawmakers from both parties opposed it.

What This Means: States can still pass their own AI regulations. The federal government isn't stepping in to override state laws about artificial intelligence.

Education and School Choice

What Changes:

- Creates $5 billion annual tax credit for private school vouchers

- Donors get 100% tax credit (dollar-for-dollar) up to $5,000 or 10% of income

- Available to families making less than 3 times their area's median income

- Can be used for private school tuition, books, tutoring, online classes, homeschooling materials

- House version runs 2026-2029, Senate version starts 2027 with no end date

- Private schools must provide special education services per IEPs

Higher Education Financing Changes:

- House version would end subsidized loans for low-income students

- New lifetime borrowing limits: $257,500 total, $200,000 for professional degrees

- Parent PLUS loans capped at $20,000 per year per student

- Removes some deferment and low-cost repayment options

- Expands 529 education savings account uses beyond just college

Pell Grant Changes:

- Students need 30 credit hours per year (up from 24) for full grant in House version

- Students with full financial aid coverage lose Pell Grant eligibility

- Expands Pell Grants to short-term workforce programs (8+ weeks)

What This Means: This creates the first-ever national school voucher program. It expands vouchers to every state—even where voters rejected them. The $5 billion comes from tax breaks for wealthy donors, not new education spending.

For Public Schools: No additional federal funding. The bill actually cuts $350 billion from education over 10 years. Public schools lose resources as Medicaid cuts eliminate $7.5 billion annually they use for health services. SNAP cuts put 16 million students at risk of losing free school meals.

For College Students: Higher education becomes more expensive and complicated. Lower-income students face reduced financial aid. Borrowing limits may force them into private loans with higher interest rates.

Reality Check: This shifts money from public to private schools without increasing overall education funding. Critics argue it undermines public education. Supporters say it gives parents more choices.

NASA and Space Funding

What Changes: $9.9 billion for NASA, including:

- $300 million for Johnson Space Center in Houston

- Funding for Artemis IV and V lunar missions

- Mars mission development

- International Space Station operations and safe deorbit

- $85 million to relocate a space vehicle between museums

- $12.5 billion for aviation and air traffic control modernization

What This Means: NASA gets a significant funding boost for space exploration. The U.S. will continue missions to the Moon and Mars. Air traffic control systems will get upgrades.

Rural Hospital Fund

What Changes:

- Creates a $50 billion Rural Health Transformation Fund over 5 years

- $10 billion per year from 2026-2030

- States must apply by December 31, 2025

- Money goes to states, not directly to hospitals

What This Means: Rural hospitals get dedicated federal funding. But they must work through their state governments to access it. This is meant to offset potential losses from Medicaid cuts.

Defense and Military Spending

What Changes:

- $25 billion for "Golden Dome" missile defense system

- $25 billion for expanding munitions production

- $9 billion for military housing improvements

- $400 million for advanced hypersonic weapons testing

- $24.6 billion for Coast Guard operations

What This Means: Major increase in defense spending focused on missile defense and military readiness. The "Golden Dome" is a new layered defense system. It includes space-based components.

For Veterans and Active Duty: The bill doesn't include direct pay raises for active duty military. Veterans get some expanded benefits. But this is primarily about equipment and infrastructure, not personnel compensation.

Will Golden Dome Work? Missile defense systems have mixed success rates. Previous systems like the Patriot missile had accuracy issues. Success depends on funding continuing over multiple years and overcoming technical challenges. Whether it keeps America "safe" is debated. Some experts say it could escalate tensions with other countries.

Tariffs and Trade

What Changes: Currently, packages under $800 can enter the U.S. without tariffs. This $800 limit is called the "de minimis threshold." The bill eliminates this threshold. After this bill, all packages face potential tariffs.

What This Means: Online shopping from overseas will become more expensive. Items from China, Mexico, and other countries will face tariffs regardless of value.

Impact on Food Prices: Imported fruits and vegetables will become more expensive. The U.S. imports about 60% of its fresh fruits and 38% of fresh vegetables. Higher tariffs mean higher grocery prices for consumers.

Manufacturing Jobs Reality Check:

The Promise: Politicians claim tariffs will create manufacturing jobs. They say this makes foreign goods more expensive, encouraging "Buy American."

The Reality:

- Tax Foundation found tariffs cancel out most tax cut benefits

- Yale Budget Lab says 80% of families lose money when you add tariffs

- Some manufacturing jobs may be created, but consumers pay higher prices for everything

Bottom Line: Tariffs act as a tax on consumers. Any manufacturing jobs created come at the cost of higher prices for everyone. This especially hurts lower-income families who spend more of their income on goods.

Court System Changes

What Changes:

- Requires bonds before people can get court orders against the government

- Makes it harder to hold government officials in contempt of court

- Plaintiffs must pay bonds matching the government's claimed losses

What This Means: It will be more expensive and difficult to sue the government. Public interest groups worry this will make it harder to challenge illegal government actions.

Medicaid and Healthcare Changes

What Changes:

- Stricter verification for who qualifies for Medicaid

- Work requirements for some Medicaid recipients

- Limits on how states can raise Medicaid funding through provider taxes

- Removes dead people from Medicaid rolls

- Prohibits Medicaid funding for Planned Parenthood for one year

- Expands Health Savings Account uses (gym memberships, fitness equipment)

Provider taxes are fees states charge hospitals and nursing homes to help fund Medicaid.

What This Means: Fewer people will qualify for Medicaid. States will have less flexibility in funding their Medicaid programs. The rural hospital fund is meant to offset some of these cuts.

Agriculture and Farm Programs

What Changes:

- Increases farm subsidies by $52 billion over 10 years for major commodity crops (corn, soybeans, wheat, cotton, rice)

- Raises price guarantees by 10-20% for commodity programs like Price Loss Coverage

- Increases crop insurance subsidies and eliminates some payment limits for wealthy farmers

- Expands definition of "beginning farmer" from 5 to 10 years for subsidies

- Permanently increases estate tax exemption to $15 million per person (up from current levels)

- Makes small business deduction permanent at 23% (benefits most farms)

Who Actually Benefits:

- Large corporate farms and wealthy agricultural operations get the vast majority of subsidies

- Only 31% of farms are even eligible for the main subsidy programs (need "base acres")

- Private crop insurance companies get an additional 6% subsidy on top of current payments

- Millionaires and absentee landlords become eligible for taxpayer subsidies again

Base acres are farmland enrolled in federal subsidy programs.

Who Gets Left Out:

- Small and mid-sized farmers who grow fruits and vegetables see no benefits

- Beginning farmers get limited help despite expanded definition

- 73.5% of farms with cropland aren't enrolled in federal crop insurance programs

How It's Paid For: The bill takes $294 billion from SNAP (food stamps) over 10 years to fund these farm subsidies.

What This Means: Despite rhetoric about "family farms," most subsidies go to the largest agricultural operations. Farm Aid argues this "benefits America's largest agricultural producers at the expense of the smallest and least resourced farmers." The bill essentially helps wealthy farmers by cutting food assistance for low-income families.

Reality Check: This continues the pattern where agricultural subsidies disproportionately benefit large commodity operations. Small diversified farms get little help.

Financial Services and Consumer Protection

What Changes:

- Cuts Consumer Financial Protection Bureau (CFPB) funding nearly in half - from 12% to 6.5% of Federal Reserve operating expenses

- Delays small business lending data collection requirements under Dodd-Frank

- Eliminates SEC technology modernization fund permanently

- Rescinds unused funds from Inflation Reduction Act green housing initiatives

- Provides $1 billion for Defense Production Act funding

What the CFPB Does: The CFPB is the federal watchdog that protects consumers from financial scams. It fights credit card ripoffs, predatory lending, and abusive debt collection. Since 2011, it has returned over $17 billion to consumers who were cheated by financial companies.

What This Means: Cutting CFPB funding makes it harder for the agency to:

- Investigate financial scams and fraud

- Supervise banks and credit card companies

- Enforce consumer protection laws

- Process consumer complaints

Who This Helps:

- Banks and financial companies that want less oversight

- Credit card companies facing fewer investigations

- Payday lenders and other fringe financial firms

Who This Hurts:

- Consumers who rely on CFPB protection from financial abuse

- Small businesses seeking fair lending

- Families dealing with debt collection abuse

Industry Response: The American Bankers Association "welcomes and strongly supports" these provisions. But 193 consumer, civil rights, and community organizations oppose the cuts. They say "Congress should stand with consumers and reject this devastating cut to the CFPB's budget."

Reality Check: This weakens the main federal agency that protects consumers from financial abuse. It makes it easier for banks and financial companies to engage in predatory practices.

These parts show how the bill benefits large corporations (big farms, banks) while reducing protections for regular consumers and small operators.

Veterans and Military Personnel

What Changes:

- $8.5 billion more for military housing, barracks, and healthcare

- Keeps veteran education protections - Senate saved rules that stop scam colleges from targeting veterans

- Cuts veteran food assistance - veterans lose help getting food if they can't work enough hours

- Cuts veteran healthcare - harder to get and keep Medicaid coverage

- No pay raises for active military

Who Uses These Programs:

- 1.6 million veterans get healthcare through Medicaid

- 1.2 million veterans get food assistance through SNAP

- Many veterans need both VA care and civilian programs

The Education Fight: For-profit colleges used to target veterans for their GI Bill money. Congress stopped this in 2023. The House tried to remove all protections. Veterans groups fought back. The Senate listened and kept the protections.

Who Wins:

- Active military get better housing

- Veterans keep education protections

- Defense contractors get more money

Who Loses:

- Veterans who can't work lose food help for 3 years

- Veterans face more paperwork to keep healthcare

- 1.3 million veterans could lose Medicaid

What Veterans Say: 32 veteran groups opposed the cuts. One leader said the Senate "listened to veterans" on education but worried about other cuts.

What This Means: Veterans won on education but lost on basic needs. The bill helps people still serving but hurts those who already served. Veterans often struggle to find work due to disabilities or lack of civilian job skills. Cutting their safety net ignores these facts.

Bottom Line: Good for active military. Mixed for veterans. Better housing and education protections. Worse access to food and healthcare.

Other Notable Changes

Gun Regulations:

- Removes suppressors (silencers) from special tax requirements

- Eliminates the $200 federal tax on suppressors

- This makes suppressors easier and cheaper to buy, not harder

Trump Accounts (Child Savings):

- Government deposits $1,000 for children born 2025-2028

- Parents can contribute up to $5,000 annually

- Money invested in U.S. stock index funds

- Earnings grow tax-deferred, withdrawals taxed as capital gains

- Available at age 18

Environmental Regulations:

- Streamlines environmental reviews for pipelines and energy projects

- Makes it easier to build oil and gas infrastructure

- Eliminates many environmental protections from the Inflation Reduction Act

- Repeals most clean energy tax credits

Housing:

- No new direct housing assistance programs for families struggling with housing costs

- No additional first-time homebuyer credits (existing programs remain unchanged)

- Expands opportunity zones and low-income housing tax credits - analysis estimates this could create 500,000 additional housing units over 10 years

- Streamlines environmental reviews for some construction projects

- Expedited permitting for energy projects (developers pay 1% of project cost or $10 million for faster government approvals)

What Are Opportunity Zones? Opportunity Zones are poor neighborhoods where wealthy investors can get major tax breaks for investing their capital gains. There are 8,764 such zones across the United States.

Here's how it works: instead of paying capital gains taxes on stock or property sales, wealthy investors can invest that money in these poor neighborhoods. They can defer taxes until 2026, reduce taxes by 10-15%, and pay zero taxes on profits if they hold investments for 10+ years.

What Type of Housing Actually Gets Built? Research shows opportunity zones primarily produce market-rate rental apartments, not affordable housing or homes for purchase. One Colorado analysis found "roughly three-fourths of projects were multifamily housing." Importantly, "there are no requirements that new apartments be rented to low-income residents"—unlike other affordable housing programs.

Who This Actually Helps:

- Real estate developers get funding and tax breaks

- Wealthy investors avoid taxes

- May increase overall housing supply in distressed areas

- Does NOT guarantee affordable housing for existing low-income residents in those neighborhoods

Reality Check: The bill could increase housing construction through developer incentives. But it provides no direct help to families who can't afford rent or down payments. The National Association of Home Builders says this will help their members "invest more resources in multifamily rental construction" and "build more single-family homes." But whether this translates to affordable housing depends on local market conditions.

Bottom Line: The bill helps developers build more housing units through tax breaks. But it doesn't address housing affordability for regular families. It's supply-side housing policy that benefits investors more than renters or potential homebuyers.

Corporate Tax Breaks:

- Permanent 21% corporate tax rate (was set to expire)

- 100% bonus depreciation for equipment purchases

- Immediate deduction for research & development expenses

- Lower effective tax rates for pass-through business income

- 2.5% tax credit for metallurgical coal production

Pass-through businesses are companies where profits go directly to owners' personal tax returns.

College Endowments:

- Higher taxes on large university endowments

- Colleges with $500,000+ per student endowments face 1.4-8% tax rates

- Estimated to raise $761 million over 10 years

Nuclear Compensation:

- Expands Radiation Exposure Compensation Act

- More people affected by nuclear testing become eligible for compensation

Immigration Fees:

- New fees for asylum applications, work permits, and court filings

- Higher costs for immigrants seeking legal status

What This Means: These provisions show the bill's broad scope beyond taxes. Gun owners benefit from easier suppressor access. Parents get new savings accounts for children. Environmental protections are weakened while fossil fuel development is encouraged. Universities face higher taxes while corporations get permanent tax breaks.

The Big Picture: Many of these changes favor specific industries or groups while cutting programs that help lower-income Americans. The lack of housing provisions is notable given the ongoing affordability crisis.

Fact-Checking the Claims

Politicians on both sides make big claims about this bill. Here's what nonpartisan experts actually found:

Republican Claims vs. Reality

Claim: "Will grow the economy and create jobs" Fact Check: Partially true, but much smaller than claimed

- Tax Foundation (business-friendly): 1.2% GDP growth over 10 years, 938,000 jobs

- Congressional Budget Office: 0.5% GDP growth over 10 years

- Penn-Wharton Budget Model: 0.4% GDP growth over 10 years

- Bottom line: Some growth, but not dramatic

Claim: "Average family saves $10,000 per year" Fact Check: Greatly exaggerated

- Tax Foundation: Middle-income family saves about $1,980 in 2025

- Penn-Wharton: Middle-income family saves about $840 in 2026

- Bottom line: Real savings are much smaller than claimed

Claim: "Reduces the deficit through economic growth" Fact Check: False

- Congressional Budget Office: Adds $3.3 trillion to deficit over 10 years

- Tax Foundation: Adds $1.7 trillion to deficit (after accounting for growth)

- Bottom line: The bill increases deficits significantly

Democratic Claims vs. Reality

Claim: "Only helps wealthy people" Fact Check: Partially true

- CBO analysis: Wealthiest 1% get average tax cut of $66,000 per year

- CBO analysis: Poorest households lose about $1,600 per year (mainly from SNAP/Medicaid cuts)

- Bottom line: Wealthy get biggest benefits, but middle-class gets some tax relief

Claim: "Will hurt working families" Fact Check: Mixed

- Most families keep current tax rates (no increase)

- Some families lose SNAP/Medicaid benefits

- Bottom line: Depends on your income and whether you use government programs

What Both Sides Agree On:

- The bill is expensive: Everyone agrees it costs trillions

- It will increase the national debt: All analyses show higher deficits

- It has some economic benefits: Even critics acknowledge modest growth

- It affects different groups differently: Rich and poor are affected very differently

The Nonpartisan Bottom Line

The Congressional Budget Office and Tax Foundation both found:

- Modest economic growth: 0.5-1.2% over 10 years

- Large deficit increases: $1.7-3.3 trillion over 10 years

- Uneven benefits: Wealthy households benefit most, poor households may lose benefits

- Job creation: Some, but not transformational

Reality Check: This bill provides tax relief mainly by extending existing rates. It adds some new breaks but pays for it by adding to the national debt and cutting some safety net programs. The economic effects are positive but modest - not the dramatic transformation either side claims.

Who Wins and Who Loses?

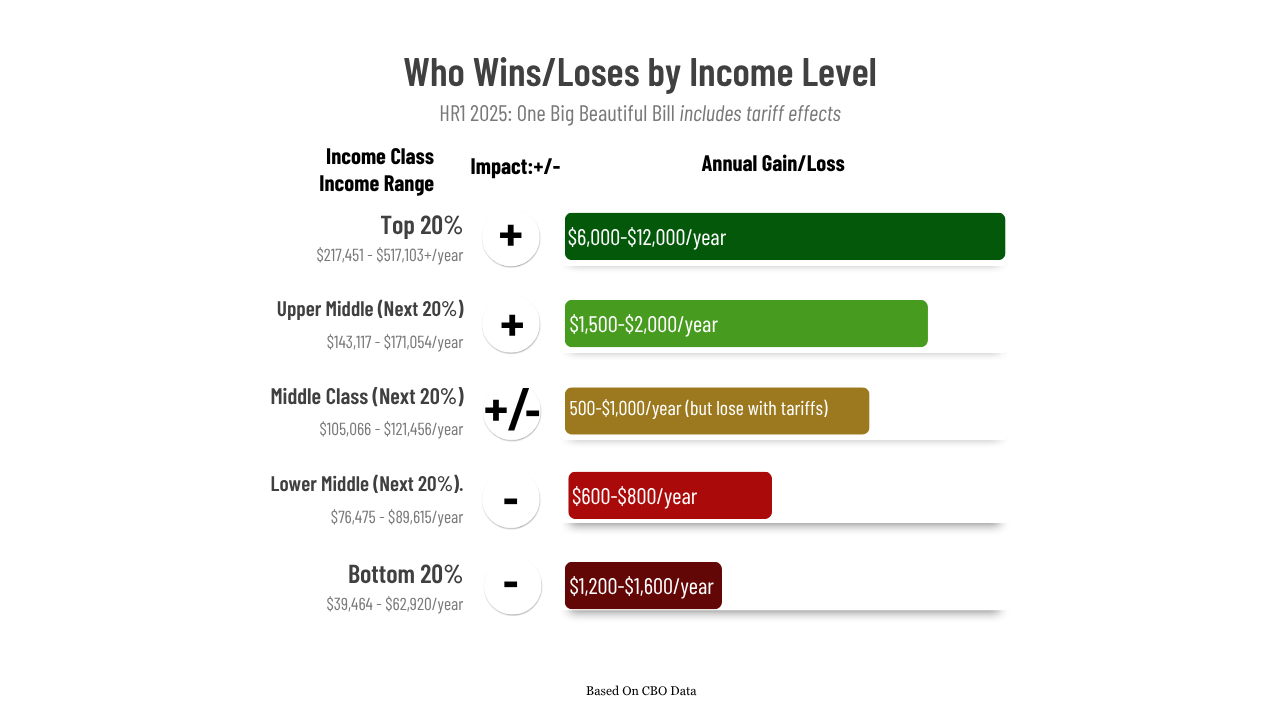

The Congressional Budget Office analyzed who benefits from HR1. When you add tariffs, the bottom 80% of families lose money while the top 20% gain money.

Here's what families actually make and what happens to them:

Bottom 10%: Make $39,464/year → CBO estimates they lose $1,600/year (additional losses from tariffs)

2nd group: Make $62,920/year → CBO estimates they lose money

3rd group: Make $76,475/year → CBO estimates they lose money

4th group: Make $89,615/year → CBO estimates they lose money

5th group (middle): Make $105,066/year → CBO estimates they gain $500/year (but analysis shows net loss with tariffs)

6th group: Make $121,456/year → CBO estimates they gain $1,000/year (but analysis shows net loss with tariffs)

7th group: Make $143,117/year → CBO estimates they gain money (but analysis shows net loss with tariffs)

8th group: Make $171,054/year → CBO estimates they gain money (but analysis shows net loss with tariffs)

9th group: Make $217,451/year → CBO estimates they gain money (may break even with tariffs)

Top 10%: Make $517,103/year → CBO estimates they gain $12,000/year (analysis shows net gain with tariffs)

The Bottom Line for Your Family

If You Make Under $90,000: You lose money according to CBO analysis. The law reduces Medicaid and SNAP benefits more than it cuts your taxes. Economic studies suggest tariffs will increase costs for goods you buy.

CBO estimates bottom 10% families lose over $1,600 per year from HR1 alone. This comes with additional losses from tariffs.

If You Make $90,000 to $170,000: CBO analysis shows you receive tax cuts from HR1. But economic studies suggest tariff costs may offset these gains for most families in this income range.

If You Make $170,000 to $217,000: CBO analysis shows you receive tax cuts from HR1. Economic studies suggest the net effect depends on your specific spending patterns and how tariffs affect goods you buy.

If You Make Over $217,000: CBO analysis shows you receive the largest tax cuts from HR1. Economic studies suggest these families benefit overall, as tax cuts exceed tariff costs.

What May Cost More:

Economic studies suggest imported goods will become more expensive:

- Groceries (the U.S. imports 60% of fresh fruit and 38% of fresh vegetables)

- Clothing (most clothing is imported)

- Electronics

- Automobiles and automotive parts

Why This Hurts Regular Families:

Poor and middle-class families:

- Spend most money on things that now cost more

- Lost Medicaid and food stamp benefits

- Don't own stocks or businesses that benefit

Rich families:

- Get huge tax cuts

- Can afford higher prices

- Own businesses that benefit from the law

Analysis Summary:

Political promises: Supporters said this would help working families.

Government analysis: CBO found that lower-income families lose resources while higher-income families gain resources. When combined with tariff effects, Yale Budget Lab analysis suggests 80% of families experience net losses.

Key findings: The law provides tax cuts while reducing spending on certain programs. The net effect varies significantly by income level, with higher-income households generally benefiting more than lower-income households.

This breakdown covers the major provisions of the One Big Beautiful Bill Act. The full bill contains hundreds of smaller changes to tax law, immigration policy, and government spending. For the complete text, visit Congress.gov and search for H.R. 1.

References

Congressional Budget Office (CBO) - Primary Government Sources:

- Congressional Budget Office. "Distributional Effects of H.R. 1, the One Big Beautiful Bill Act." June 13, 2025. https://www.cbo.gov/publication/61387

- Congressional Budget Office. "Estimated Budgetary Effects of H.R. 1, the One Big Beautiful Bill Act." May 22, 2025. https://www.cbo.gov/publication/61461

- Congressional Budget Office. "H.R. 1, One Big Beautiful Bill Act (Dynamic Estimate)." 2025. https://www.cbo.gov/publication/61486

- Congressional Budget Office. "How H.R. 1, the One Big Beautiful Bill Act, Would Affect the Distribution of Resources Available to Households" (Interactive Tool). June 13, 2025. https://www.cbo.gov/publication/61469

- Congressional Budget Office. "Preliminary Analysis of the Distributional Effects of the One Big Beautiful Bill Act." May 20, 2025. https://www.cbo.gov/publication/61422

Academic Research Sources:

- Yale Budget Lab. "Combined Distributional Effects of the One Big Beautiful Bill Act and of Tariffs." 2025. https://budgetlab.yale.edu/research/combined-distributional-effects-one-big-beautiful-bill-act-and-tariffs

- Penn Wharton Budget Model. "House Reconciliation Bill: Illustrative Calculations with Permanence." May 20, 2025. https://budgetmodel.wharton.upenn.edu/issues/2025/5/20/house-reconciliation-bill-illustrative-calculations-with-permanence-may-20-2025

Official Government Sources:

- U.S. Congress. "H.R. 1 - One Big Beautiful Bill Act." 119th Congress, 2025. https://www.congress.gov/bill/119th-congress/house-bill/1/text

- U.S. Senate Committee on Finance. "One Big Beautiful Bill: New Tax Relief Overwhelmingly Benefits Working Class." July 1, 2025. https://www.finance.senate.gov/chairmans-news/one-big-beautiful-bill-new-tax-relief-overwhelmingly-benefits-working-class

- U.S. Department of Agriculture, Foreign Agricultural Service. "Agricultural Trade Data." 2024. https://fas.usda.gov

Independent Tax Policy Analysis:

- Tax Foundation. "One Big Beautiful Bill Act Tax Policies: Details and Analysis." July 3, 2025. https://taxfoundation.org/research/all/federal/big-beautiful-bill-senate-gop-tax-plan/

- Institute on Taxation and Economic Policy. "Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates." June 25, 2025. https://itep.org/analysis-of-tax-provisions-in-house-reconciliation-bill/

Fiscal Policy Analysis:

- Committee for a Responsible Federal Budget. "Breaking Down the One Big Beautiful Bill." May 12, 2025. https://www.crfb.org/blogs/breaking-down-one-big-beautiful-bill

Fact-Checking and Verification Sources:

- FactCheck.org. "Unraveling the Big Beautiful Bill Spin." July 3, 2025. https://www.factcheck.org/2025/07/unraveling-the-big-beautiful-bill-spin/

- PolitiFact. "Fact-checking falsehoods about Trump's 'Big Beautiful Bill.'" June 24, 2025. https://www.politifact.com/article/2025/jun/24/one-big-beautiful-bill-trump-taxes-senate/

If this blog gave you insight, the community will give you depth, strategy, and the tools to transform your finances. Spots are limited—join the waitlist today!